In the increasingly digital and fast-paced travel industry, fraudsters are constantly developing new tactics to score free travel and leave advisors on the hook for the cost. Here’s a look at common scams to watch out for, how AI is making it easier for fraudsters to fly under the radar and what you can do to protect yourself.

Scam No. 1: The Friendly Fraudster

Imagine you plan a client’s romantic getaway to the Caribbean: business-class flights, five-star resorts, custom excursions, the works. A week after they return, you’re hit with a nasty surprise: The client has disputed the charges for the trip with their credit card company.

The client agreed to the cost of the trip and seemed happy with the experience. But now you’re spending hours trying to prove to the credit card company that these charges are legit. What gives?

It’s called “friendly fraud,” and it happens when customers use the credit card dispute process to avoid paying charges they previously agreed to. This type of fraud has been on the rise since the early days of the pandemic, said Amy Butters, senior director of accounting operations at ALG Vacations, when people were advised to dispute charges for canceled travel arrangements that vendors refused to refund.

“All of a sudden, consumers were educated on how easy it is to do a chargeback,” she noted.

Now, some travelers — Butters calls them “professional chargebackers” — are using the same process to game the system and avoid paying for trips they’ve already taken and enjoyed.

“They’re people who are trying to get something for nothing. If they don’t want to pay this bill, they’ll just do a chargeback,” Butters said.

For travel advisors, it can result in significant financial losses and hours of paperwork.

How To Protect Yourself:

Whenever you’re booking travel for a client, make sure you validate their identity, receive a formal authorization for the transaction and get them to agree to your terms and conditions before finalizing the payment. You should also use a secure payment link for the transaction, which can gather data on the end user, along with a signed credit card authorization form, Butters said.

This type of documentation can help you make your case to the credit card company if the client disputes the charges.

Don’t be afraid to dig deep for evidence to support your case. Butters said that some travel advisors have even grabbed vacation photos their client posted on Facebook to prove they took the trip.

“Anything you can do to prove that this person truly did use their vacation can help your claim,” she said.

Scam No. 2: The Rogue Contractor

Picture this: Your agency is thriving, and you’ve just onboarded a new independent contractor to help manage the influx of inquiries. Their background check came back clean; their identification checked out, and they seemed great during their interview. You felt confident they’d be able to hit the ground running.

And hit the ground running they did — but not in the way you’d hoped. As soon as they got their credentials, they went on a booking spree. Sounds great, but it turns out the credit cards they used were stolen numbers — perhaps obtained from the dark web or another shady source — and you started getting hit with chargebacks. You shut down their accounts and scrambled to request refunds, but it was too late: Some tickets had already been used, and the damage was done.

This isn’t a hypothetical scenario — it actually happened to an agency that works with ALG Vacations, a tour operator that serves more than three million travelers every year through its six brands, which helped the agency manage the fraudulent charges. ALG Vacations and its client wrote to the large U.S.-based airline through which many of the flights were booked, and after several meetings, they were able to whittle down the agency’s liability to $12,000.

“The damage started out at more than triple that amount, so it was a bit of a success story, but it still hurts,” Butters said. “It really stunned the agency’s owners.”

How To Protect Yourself:

Conducting due diligence is essential for identifying bad actors before they join your team, but your defenses shouldn’t stop once the contract is signed and the onboarding is complete. Butters recommended running daily booking reports through VAX VacationAccess (or other booking tools and software you use) to spot dubious activity early on. Keeping an eye out for unusual reservations, like an excessive number of bookings (especially high-value trips), can help you recognize potential fraud and address it before it spirals out of control.

Scam No. 3: The Last-Minute Liar

Rogue independent contractors aren’t the only scammers using stolen credit cards to defraud travel advisors. Thieves also pose as new clients in need of expensive travel arrangements for either a typical vacation or an “emergency” situation (like a relative’s ailing health). They provide stolen credit card information to make the payment and once they receive the confirmation numbers, they change the traveler names and trip dates of the reservations directly with the airline for immediate travel.

“They work in a ring: People are already at the airport, and they’re just waiting for the go-ahead to get on the next flight. It happens really quickly,” Butters explained.

In these high-pressure situations, travel advisors don’t have time to do their due diligence. Even when they try, fraudsters are prepared. They create counterfeit IDs using AI-powered image-editing software that makes them almost indistinguishable from legitimate documentation.

By the time the fraud is uncovered, the tickets have been used, the reservations are long gone and the advisor is hit with a chargeback, leaving them to foot the bill for the fraudulent charges.

How To Protect Yourself:

The potential commission on a last-minute, high-value trip can be tempting, but don’t let urgency override caution, said Cornelius Hattingh, director of revenue integrity, accreditation and compliance at Airlines Reporting Corporation (ARC), which has the world’s largest repository of global airline tickets.

“If this is business you don’t normally do and you suddenly get a request for travel for a large group in the near future, always be wary of that. It’s one of the most prevalent scams we deal with on a regular basis,” Hattingh said.

Take the time to verify a new client’s identity. Scrutinize their ID to spot signs of manipulation, like mismatched typefaces, inconsistent shadows or changes in sharpness. You could Google their name to see if it comes up on legitimate profiles on social media sites, which could add to their credibility.

If you received the inquiry by phone, call them back, Butters said.

“See if that person is truly at that phone number. We have a lot of advisors say that the client’s phone number is disconnected or doesn’t work, which is a red flag,” she added.

And, of course, make sure the name on the credit card matches the name of the person making the reservation. Butters noted that in some cases, a third-party does pay for the vacation costs, but it’s still important to know your customer and ask questions.

In an abundance of caution, you might also consider setting up a policy against making last-minute arrangements for first-time clients. Reserve this as a benefit for repeat customers you trust.

Scam No. 4: The Phisherman

Phishing scams, which involve fraudulent emails or websites designed to trick people into revealing login credentials or other sensitive information, are nothing new in the travel industry. However, advancements in AI are making them harder to spot, Hattingh warned.

“There are concerns that the type of enhancements available through AI could cause phishing to increase,” Hattingh explained. “They lure you in with better grammar. Spelling errors, which used to be a good giveaway of someone trying to mislead an individual, are no longer a telltale sign.”

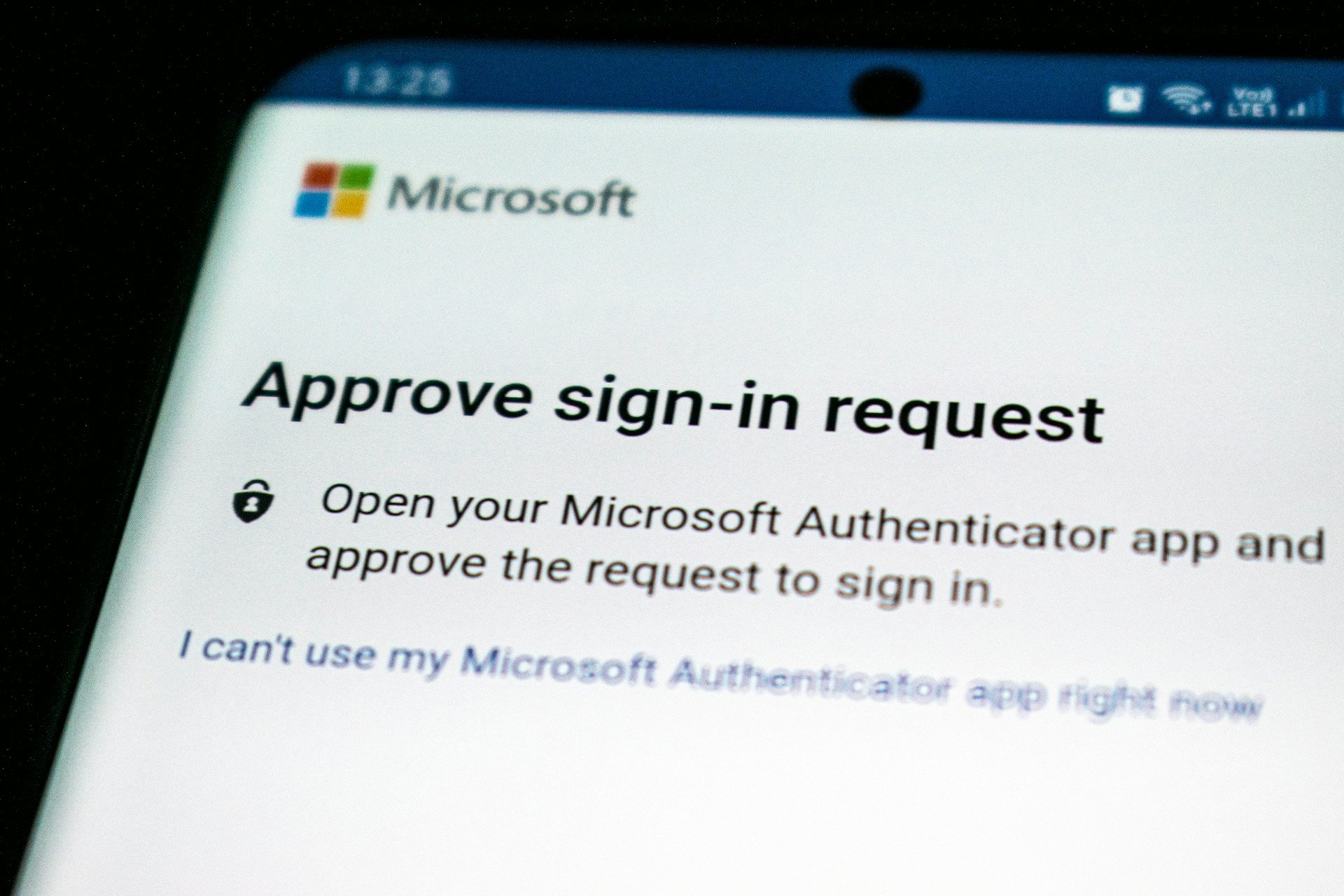

These scams can take many forms. For instance, you might receive what appears to be a password reset request from the software you use to book travel for clients. But when you click the link and enter your credentials, you unwittingly hand over control of your account to fraudsters. In some cases, fraudsters even set up entire websites that mimic those of legitimate companies to harvest data.

How To Protect Yourself:

Scrutinize any email and link you receive requesting your log-in details or a password reset. Service providers will never ask you for your username and password. Look at who is sending the message and whether their email address matches the domain of the company you think you’re dealing with. When in doubt, give them a call at the number listed on their website to see if they were responsible for the message.

If available, set up multi-factor authentication on your accounts — it gives you one more layer of security against fraudsters. ARC also recommended updating your passwords every one to three months to reduce the risk of a compromised account. Before inputting your data on any website, take a look at the address bar in your web browser to make sure you’re on a company’s legitimate website.

Don’t give fraudsters a one-way ticket to your profits. While these bad actors are always scheming for new ways to exploit the travel industry, you can stay one step ahead by keeping up with the latest scams, implementing smart hiring and tech practices and staying on guard. Taking the right precautions can ground their schemes for good.

Originally appeared in the Spring 2025 issue of The Compass magazine

Renee M | 02/25/26 - 09:54 AM

Thank you! I am a new travel agent and I appreciate the extensive training and inforamation!

| reply ⋯